Success Stories

Avenue’s Growth transformation: Bridging finance, marketing, and data for profitable growth

This case study explores how Avenue, a U.S.-based investment firm serving Brazilian investors, partnered with Winclap to overhaul its growth strategy. By integrating financial discipline, marketing automation, and a unified growth model, Avenue doubled its LTV/CAC ratio and implemented a scalable framework aligned with long-term business objectives.

The Challenge: reconnecting revenue and returns

After a period of rapid early-stage growth, Avenue faced structural challenges that constrained its ability to scale profitably. Despite a strong market position in the cross-border investing market, a misalignment between customer acquisition efforts and financial outcomes pressured the company’s 2025 revenue outlook.

"We experienced explosive growth in the early years of our operation. As we matured, we understood that the spontaneous and disorganized growth from the beginning, while bringing results, also created significant operational challenges and energy loss in several work fronts."

Key issues included:

- Customer acquisition misalignment: There was potential to better align marketing strategies across paid, owned, and earned channels to attract higher-value customers and enhance unit economics.

- Unfavorable CAC/LTV dynamics: Acquisition costs exceeded customer lifetime value, limiting profitability and scalability.

- Low retention and reactivation: Engagement and Assets Under Custody (AUC) stagnated, lowering customer lifetime contribution.

- Operational and technical fragmentation: Despite access to marketing technology platforms and abundant data resources, Avenue had opportunities to enhance system integration, leverage existing tools more effectively, activate customer insights strategically, and streamline manual processes for greater efficiency.

Avenue recognized the need to turn around its growth strategy and how critical it was to bring financial logic and marketing execution into a unified operating model.

Reframing Growth: why an external perspective was essential

Initially, Avenue’s leadership hesitated to involve an external consultant in such a core capability.

"My first impression about working with an external partner like Winclap didn't feel natural,” admits Lee. Major questions arose: Is this activity too central to be outsourced? Are the data and intelligence we generate too fundamental to be shared with an external partner?"

However, several factors led Avenue to move forward with Winclap:

- Deep expertise in growth marketing and customer monetization, including CAC/LTV optimization and lifecycle management.

- Independent, unbiased analysis, grounded in external benchmarks, and free from internal assumptions.

- Structured methodology, aligning business goals with operational execution through a rigorous diagnostic and planning process.

- Executional agility, enabling rapid hypothesis testing and iteration that accelerates learning and impact.

- Technical proficiency, supporting improved attribution modeling, behavioral analytics, and Martech integration.

- Cross-functional collaboration, bridging marketing, analytics, and finance to ensure enterprise-wide cohesion.

Despite initial hesitation, once Avenue’s senior leadership committed to the partnership, they became active allies—mobilizing quickly, championing cultural change, and removing organizational roadblocks. Their alignment and decisiveness empowered Winclap to execute quickly and deliver measurable impact.

Building the bridge: aligning financial discipline and Growth execution

Winclap led a transformation plan grounded in financial discipline, behavioral insight, and marketing performance. The engagement was structured in two phases:

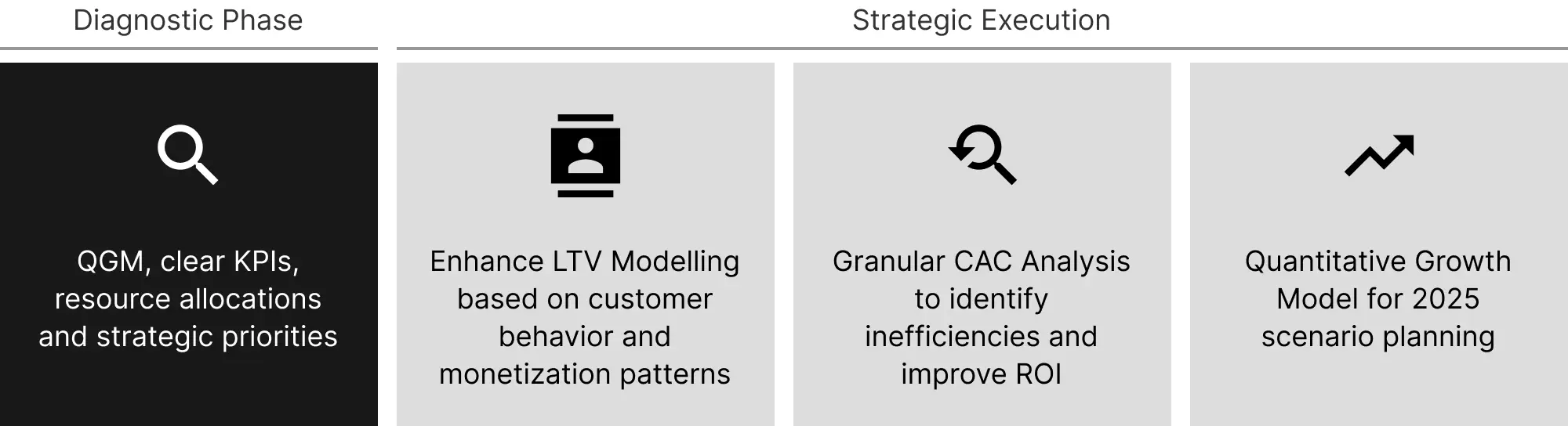

1. Diagnostic Phase

The initial assessment mapped out Avenue’s growth architecture across acquisition, branding, retention, technology, and modeling, and identified critical capability gaps and opportunities for acceleration. Leveraging Winclap’s proprietary QGM (Quantitative Growth Model), clear KPIs, resource allocations, and strategic priorities grounded in financial logic were established.

2. Strategic Execution

A data-informed growth roadmap was developed to directly link marketing inputs to financial outcomes. Key components included:

- Enhanced LTV modeling: Lifetime value was recalibrated based on customer behavior and monetization patterns.

- Granular CAC analysis: Customer acquisition costs beyond paid media were allocated at the channel level to identify inefficiencies and improve ROI.

- Quantitative Growth Model (QGM): This forecasting and measurement framework connected all acquisition, retention, and monetization initiatives into a single financial model, which became the foundation for 2025 scenario planning.

Winclap worked side-by-side with Avenue teams across four core execution pillars:

- Customer acquisition: Improved campaign efficiency by enhancing attribution tools (AppsFlyer, GA4) and targeting higher-LTV customer segments.

- Retention & engagement: Launched 40+ automated CRM journeys, improving personalization, reactivation, and product usage.

- Brandformance: Shifted from short-term performance marketing to a full-funnel approach that balanced awareness with conversion within ROI/ROAS targets.

- Data and Martech integration: Unified customer data across platforms, improved event tracking, and optimized journeys with accurate behavioral insights

Winclap’s collaborative approach ensured that strategic recommendations were translated into operational action, aligning departments and tying execution back to financial outcomes.

Outcomes: financially disciplined Growth at scale

The transformation yielded measurable improvements in marketing efficiency, customer value, and organizational alignment.

“Thankfully, we tested working with Winclap, and the results were tremendously incredible”, emphasizes Lee. “Looking back, we could not have built these capabilities in-house because of the expertise, DNA, and technical knowledge involved.”

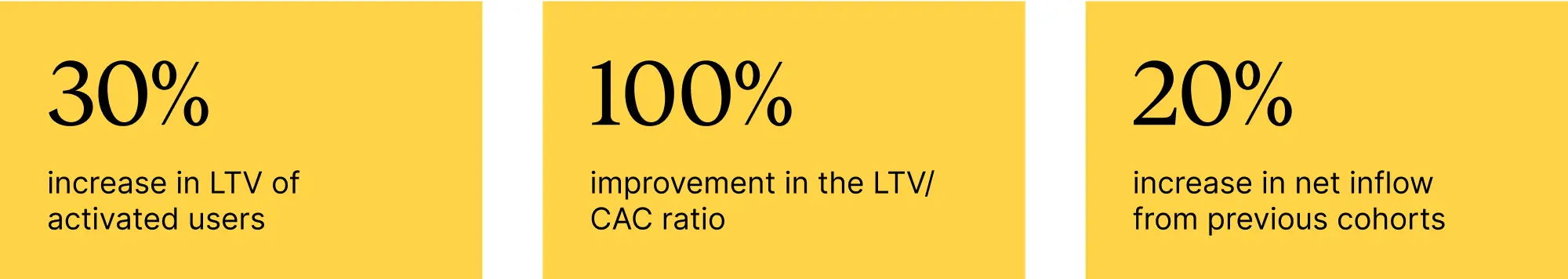

Key outcomes included:

- +30% increase in LTV of activated customers

- 100% improvement in the LTV/CAC ratio within 6 months

- +20% increase in net inflow from previous customer cohorts

- A fully integrated growth operating model, finance, marketing, product, IT, data and commercial teams.

- Advanced Martech capabilities enable better segmentation, targeting, and measurement.

Beyond performance metrics, the initiative reshaped how Avenue approached growth in-house:

“Winclap gave us a very analytical vision of building growth strategies,” explains Lee.”The impact exceeded our expectations and generated an internal work culture more focused on deeply understanding our customers’ behaviors, what makes them happy, and where they see the most value in our work.“

Next steps: sustaining value creation through customer-centric finance

The partnership established a foundation for long-term value creation.

“Moving forward, as Avenue’s value proposition becomes clearer to the general public and as Brazilians increasingly understand the importance of diversifying their assets outside Brazil, we will invest more heavily in strengthening customer relationship capabilities,” projects Lee. “Not just at the acquisition stage, but throughout the entire relationship journey we have with each of our investors.“

The focus now turns to deepening relationships and tailoring the product portfolio to evolving customer needs:

“This requires deeply understanding our customers—where they see value, where we can improve, what the future of their relationship with us looks like, how to engage more with different types of products, and which products we need to launch,” concludes.

By institutionalizing the link between marketing execution and financial performance, Avenue is positioned to scale sustainably, adapt strategically, and unlock long-term value across its customer base.

Participants