BLOG | December 23, 2022

Marketing Efficiencies Playbook - LTV Optimization

By Bernardo Tinti – Measurement & Impact Lead at Winclap

This article is part of the Marketing Efficiencies Playbook, a joint effort from Winclap and Softbank Latin America Fund to bring experts’ knowledge to leading startups and marketers to increase their efficiency and transform how they grow.

Media spend optimization based on LTV

When marketers talk about “media spend optimization”, they usually refer to acquiring and retaining users at the lowest possible cost. In this post, we’ll introduce a more comprehensive approach, “customer lifetime value (LTV) media spend optimization”, and show why it may be a better framework for marketing decisions.

In short, marketers to optimize their investment, marketers should aim towards maximizing revenue rather than minimizing costs.

What is LTV and how is it measured?

Customer lifetime value is a measure of the overall profit that a customer will generate in their “lifetime” as a user of the product or app. In other words, LTV represents the real value that a new user will bring to the business. It constitutes a key metric that any company should track. The problem is, not all of them pay sufficient attention to this. (that’s why we wrote this post)

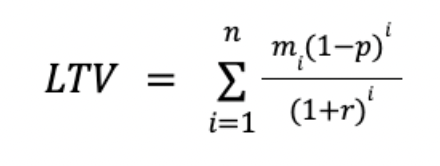

Formally, LTV can be defined as the net present value of the revenue streams a customer generates (adjusted by churn probability and a financial discount factor). This can be summarized in the following general formula:

where i denotes each time period, n denotes the total number of time periods for which the user is expected to engage with the product, m represents the total revenue or profit generated by the user in each time period, p is the churn probability in each period, and r denotes the financial discount factor (an interest rate).

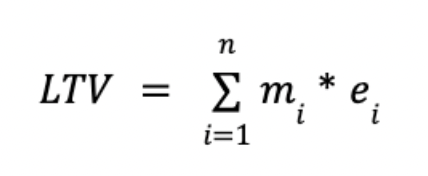

This formula may look a bit complex, but it can easily be adapted to any particular business model and simplified for a more basic analysis. For example, customer LTV for a platform which generates revenue through yearly subscriptions can be simplified in the following way:

where n denotes the number of years considered in the analysis, m is the price for a yearly subscription and e is a measure of user retention in each year.

It is important to distinguish customer LTV from average revenue per user (ARPU). ARPU is defined as the total revenue generated in a specific time period divided by the number of active users in that period. In this way, ARPU is a metric restricted to a specific time period and it doesn’t incorporate any measure of user retention and recurrency over time.

Since LTV is directly determined by customer behavior (how much they spend, how often they buy, etc) and different users behave in different ways, it comes to reason that LTV can be very variable across users. This leads us to the central topic of this post:

If users have different LTVs, is it reasonable to pay the same CAC for acquiring every user?

Why is LTV optimization important?

As we have already mentioned, marketers usually approach “media spend optimization” as growing the total user base at the lowest cost per user. Considering what we know now about LTV, it is clear that this is only half the story. Marketers who are only concerned with minimizing overall CAC without contemplating customer LTV are risking “selling a dollar for a quarter”:

- by paying low CACs for users which may have even lower LTVs (Low CAC but Lower LTV)

- by not being willing to pay higher CACs for users whose value may highly exceed their acquisition costs. (High CAC but higher LTV)

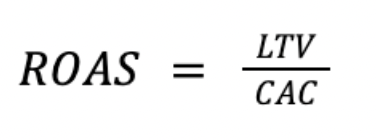

In order to see the whole picture, a metric comprising both CAC and LTV should be considered. This is where the return on advertising spend (ROAS) comes into play. ROAS can be defined, in a simple way, as the quotient of LTV over CAC.

ROAS provides a quick and simple way to understand if a marketing initiative is repaying itself or if it’s compromising business efficiency and sustainability. Measuring and comparing ROAS between different marketing initiatives is henceforth an optimal way to prioritize their execution and avoid selling a dollar for a quarter. Optimization towards ROAS requires that initiatives with negative ROAS are cut right away (unless they’re justified by strategic reasons). Furthermore baseline ROAS expectations need to be agreed beforehand across multiple teams, including finance, business and marketing, in order to guide marketing investment decisions.

Using technology to optimize ROAS

There are plenty of martech solutions that help optimize your campaigns towards a target ROAS. For example, Google lets you set a ROAS goal and predicts a conversion rate based on your values. It uses that prediction to optimize your bids based on your target. This can be done in several medias. We recommend you check with your media partner what kind of optimization features they offer an see if that aligns with your campaign goal.

At Winclap we have developed the Budget Allocator tool that uses machine learning models to recommend the optimal budget in each media channel. With this tool marketers can set a ROAS target and optimize their budget accordingly to maximize their campaigns return.

If you enjoyed this post be sure to check other articles of the Marketing Efficiency Playbook, where we talk about LTV Optimization, Fraud, Incrementality and more.